Business e-Banking Services

Business Banking has never been easier.

Manage your company finances and account details all in one place, anytime, anywhere.

• Convenient with 24/7 access

• No application fee

• Strict security measures

• Customize employee access to business banking accounts

• Stay Alert

• Enjoy online discounts

Key Services

Account/Loan Overview

Apart from managing local bank accounts, you can also check account balances of Hang Seng China anytime, anywhere with ease after successful application. Download Form

Ever Earn

Participate in missions to earn great rewards for performing banking tasks.

Business Information Amendments

Easily update business information by submitting online instructions. Submit online instructions to update company account-related information, including company information and portfolio daily limits.

FX Order Watch

Enable customers to place FX orders online to buy or sell FX at a target rate via either Hang Seng Business e-Banking or Hang Seng Business Mobile Banking.

Fund Transfer

Save time by managing your transfers and payments online.

One-Click Time Deposit

Save your money for a set period of time to enjoy preferential time deposit rates.

Loan Application

Explore our Priority Approval Offers and submit your applications online.

Payment Tracker **

Track in real-time the progress of all incoming or outgoing payments.

Faster Payment

Allow 7x24 real-time transfers between local banks.

Bill Payment

Pay bills online to a wide range of merchants.

Xero

Link your bank account to Xero’s online accounting platform to get an up-to-date view of your cash flow.

e-Banking Services Overview and Details

Hang Seng Business e-Banking services provide a simpler, faster and more cost-effective way to access your business accounts and manage your company's finances anytime, anywhere.

The following is a list of services available in Hang Seng Business e-Banking:

Ever Earn

- Explore available missions and track mission progress

- Check rewards earned from missions and redeem rewards online or at physical redemption points

Cash Management

Account / Loan Overview

- Check local account balances and transaction activities

- Check account balances of Hang Seng China after successful application (Download the application form)

Fund Transfer

- Transfer between own Hang Seng Accounts

- Faster payment system – 7x24 Real-time transfers between local banks

- Add/Amend/Delete/Enquire beneficiary account details

- Offer 24-hour online FX exchange service of 9 major currencies.

FX Order Watch

- Set up Target Limit Order of 9 major currency pairs to trade FX at designated exchange rate.

- Set up Rate Alert target instruction and receive SMS/ email notification(s) when the targeted rate is reached.

- Receive the latest FX market news and FX exchange rate charts.

Pending Instructions

- Check details of pending instructions

- Deposit e-Cheques

- Enquire e-Cheques status

Bill Payments

- Make direct payment online at any time to more than 350 merchants

Time Deposits

- Place, renew, and amend time deposit instructions

- Make bulk payments to a number of beneficiaries such as salary and other payments

- Expedite the availability of your regular receivables from customers

Hang Seng Faster Payment Registration

- Use mobile number/email address/FPS ID to register/amend/delete FPS service

Manage Third Party Connection

- Establish the Third Party Connection with Xero, your account statement data, such as account balance and transaction details, will be automatically shared with Xero from every Monday to Saturday, commencing after two business days.

Overseas ATM Limit

- Maintain Overseas ATM Daily Withdrawal Limit for ATM cards and credit cards

Loan & Facility

Loan Application

- Apply for a loan with a Priority Approval Offer

Facility Details

- View credit limits, facility usage and available limits of all facilities for up to three related companies

Credit Card

+FUN Dollars Gift Parade

- Redeem credit card +FUN Dollars with various options in gift catalogue

Forms Download

- A form download center with all required forms for credit card applications

Trade Transaction Tracker

Investments*

Securities Trading Services

- Trade local securities and Stock Connect Northbound Trading securities and get real-time securities quotes

Investment Funds Services

- Subscribe, redeem and switch investment funds

MaxiInterest Investment Deposit and / or Capital Protected Investment Deposit Services

- Subscribe for MaxiInterest Investment Deposits and Capital Protected Investment Deposits

Insurance*

- Enquire about life insurance policies with Hang Seng Insurance Company Limited

- Apply online for office insurance

MPF and Payroll Services

- Prepare and submit MPF remittance statements and payroll instructions

e-Services

- View designated account statements of up to the past 7 years

- View cash management advices and trade services advices

- View designated advices of up to the past 180 days (from the date of delivery)

- Keep abreast of the latest transaction status of your account via email, SMS and Business e-Banking platforms

Important Mails

- Receive inbox message notification from the Bank

Management Control

Company Information Update

- Update the company's address and/or contact information

Portfolio Daily Limits

- Decrease portfolio daily limits

- Increase portfolio daily limits

Authorization Settings

- Assign/amend/delete access rights*

User Profile

- Check access rights and information of different users

Activate User

Authorisations

Cash Management

- Authorise cash management-related transactions

Investments

- Authorise investment instructions

Management Control

- Create users and assign access rights for all users*

- Authorise instructions on decreasing portfolio daily limits and updating company information

Pending Approval

- Approve instructions on increasing portfolio daily limits

Request for Cheque Book

- Submit request for new cheque books

Request for Statement Copy

- Make request for account statements

Request for Certificate of Account Balance

- Submit request for certificate of account balance

Courier Service – Acknowledge Receipt

- Acknowledge ATM Card and Phone PIN to activate banking channels

End Point Security

- Download Webroot SecureAnywhere for free

Security Device Replacement

- Make replacement for security devices

WeChat / SMS Service Setting

- WeChat account binding and settings for receiving notifications through WeChat and SMS

Contact Information

- Contact information of Hang Seng Bank

Exclusive e-Banking Offers

Click to view online discounts for Business e-Banking

Contact Us

Call 2198 8000

Visit our Branches

Watch Now

Make the most of Online Banking Remittances, Foreign Exchange and Time Deposit Offers

Protect your Personal Digital Keys, beware of fraudulent links

Easily update business information by submitting online instructions

Apply for your Business e-Banking account in two easy steps:

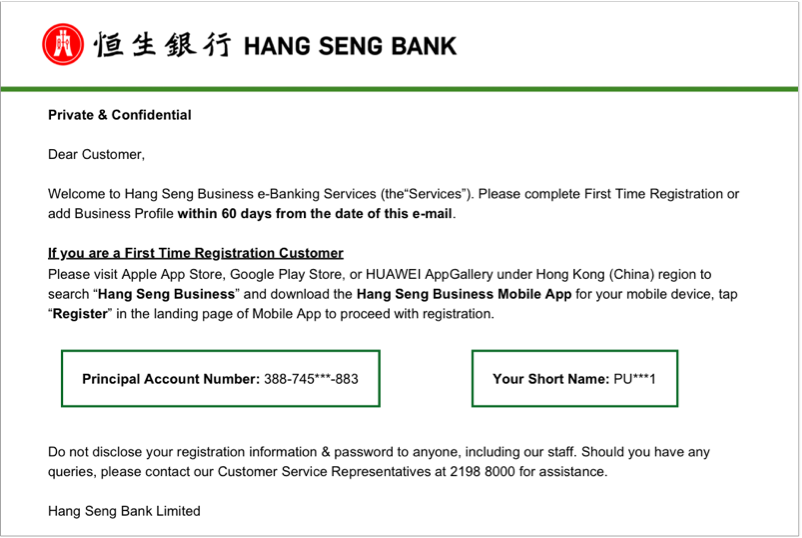

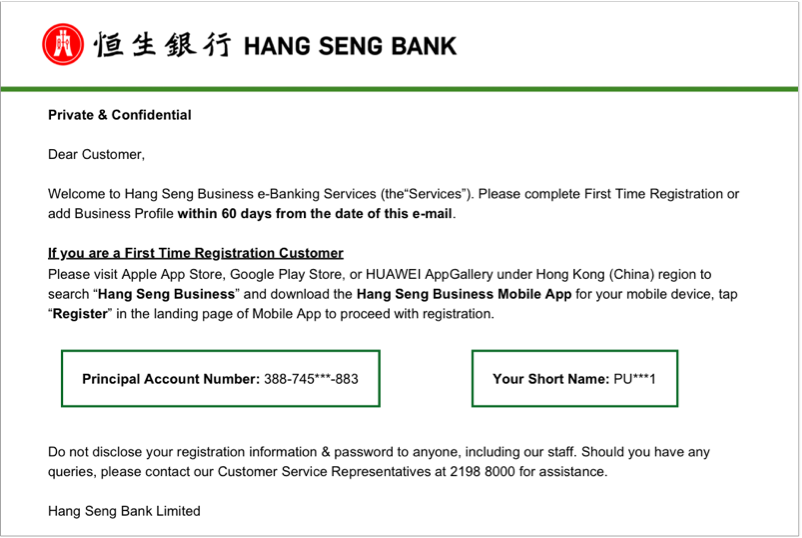

Step 1: Fill in Application Form  Step 2: Register your e-Banking Account In order to register for Business e-Banking, you will receive a Hang Seng Business e-Banking Registration e-mail that contains “Principal Account Number” and “Your Short Name”. Please download the Hang Seng Business Mobile App to register for Business e-Banking with the above information and follow the instruction for registration.

Step 2: Register your e-Banking Account In order to register for Business e-Banking, you will receive a Hang Seng Business e-Banking Registration e-mail that contains “Principal Account Number” and “Your Short Name”. Please download the Hang Seng Business Mobile App to register for Business e-Banking with the above information and follow the instruction for registration.

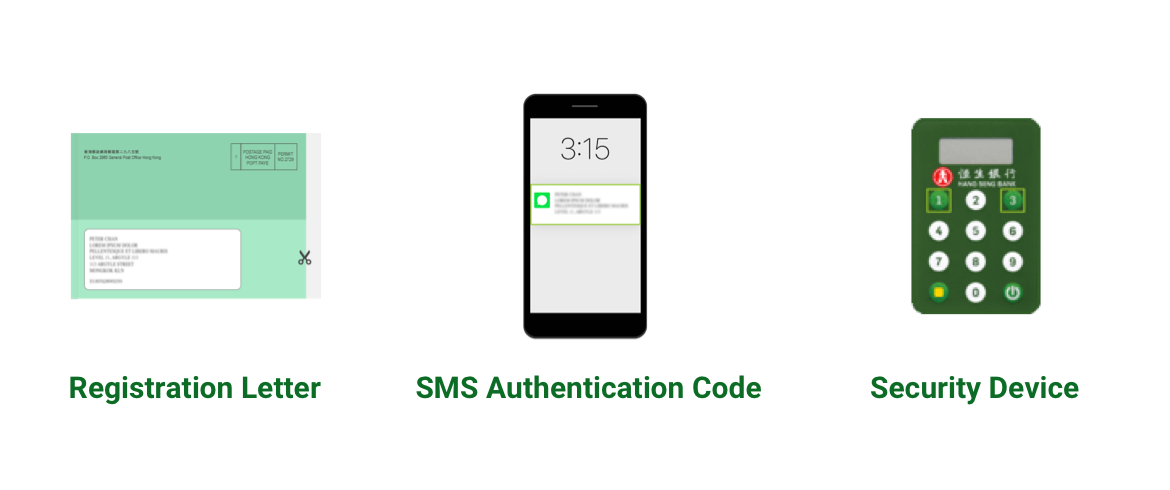

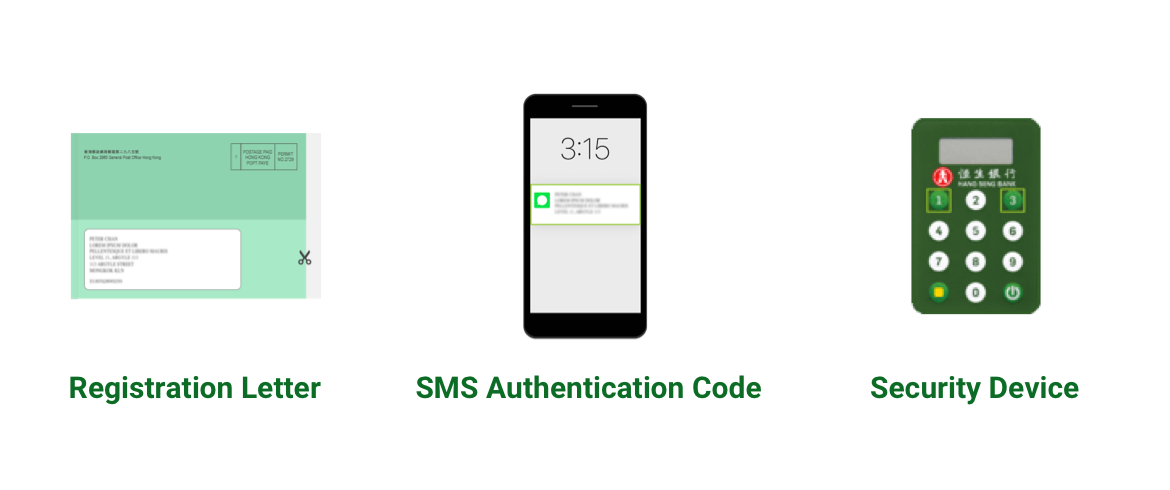

Or if you have requested Security Device, please register for Business e-Banking with Registration Letter, SMS Authentication Code and Security Device (if applicable).

Manage Accounts on our App

You can now manage your Business e-Banking accounts via mobile by installng our Hang Seng Business Mobile App on your handsets. Click here to learn more.

System Requirement

- Minimum specifications for using Business e-Banking

- An operating system using Windows 7 or above (English or Chinese version)

- Best viewed with Chrome 85 / Edge 88 or above, with JavaScipt enabled

- Screen resolution of 1024 x 768 or above

To borrow or not to borrow? Borrow only if you can repay!

Foreign Currency Risk

Foreign exchange involves exchange rate risk. Fluctuations in the exchange rate of a foreign currency may result in gains or losses in the event that the customer converts HKD to foreign currency or vice versa.

RMB Currency Risk

Renminbi (“RMB”) is subject to exchange rate risk. Fluctuation in the exchange rate of RMB may result in losses in the event that the customer subsequently converts RMB into another currency (including Hong Kong Dollars). Exchange controls imposed by the relevant authorities may also adversely affect the applicable exchange rate. RMB is currently not freely convertible and conversion of RMB may be subject to certain policy, regulatory requirements and/or restrictions (which are subject to changes from time to time without notice). The actual conversion arrangement will depend on the policy, regulatory requirements and/or restrictions prevailing at the relevant time.

Please note that we may change the scope of the services made available in Hang Seng Business e-Banking from time to time.

* The services are not applicable to organisation customers.

** “Payment Tracker” gets its latest transaction status from SWIFT gpi service. If the intermediary/beneficiary bank has not provided this information to SWIFT gpi, the transaction status shown may not be the most up to date. If you have any questions, please contact our Customer Service Representatives on (852) 2198 8000.

![]()

Step 2: Register your e-Banking Account In order to register for Business e-Banking, you will receive a Hang Seng Business e-Banking Registration e-mail that contains “Principal Account Number” and “Your Short Name”. Please download the Hang Seng Business Mobile App to register for Business e-Banking with the above information and follow the instruction for registration.

Step 2: Register your e-Banking Account In order to register for Business e-Banking, you will receive a Hang Seng Business e-Banking Registration e-mail that contains “Principal Account Number” and “Your Short Name”. Please download the Hang Seng Business Mobile App to register for Business e-Banking with the above information and follow the instruction for registration.